The note below was a letter to the editor in the El Paso Times recently:

Property owners stretched to the limit

Why are property owners in El Paso constantly being asked to cough up more money?

Paving streets and operating within allotted budgets seems would be a priority. Costly ballpark, a demolished City Hall, the trolley car debacle, missing millions, new bus terminals and empty buses, and tax abatements for new businesses for years. Guess who is shouldering this cost?

Combine that with our dysfunctional school system, with their bond money, that would choke a donkey. Wages here aren’t in line with our progress. My quality of life doesn’t allow me to water my lawn anymore.

As a taxpayer, wouldn’t it be nice if you could have a bond election every time your checkbook was short?

Greg Allen

West El Paso

********************************************

Well said Mr. Allen.

We deserve better

Brutus

There are more non-taxpayers in El Paso than there are taxpayers. This is primarily why elections always swing toward higher taxes (children’s hospital, ballpark, quality of life bonds, etc.) because these people could care less what anything costs, it is free to them. It doesn’t even take many of them to vote in these spending sprees, we have very low voter turnout.

Robert Francis O’Rourke is now proposing that El Paso become the “new Ellis Island” and allow unchecked immigration to pour through this area. Allowing millions of people with no money into El Paso will certainly help everyone, most of all the taxpayer. I don’t get free medical care from UMC but they do.

LikeLike

it is hypocritical to conflate illegal immigration with legal immigration. further, it is even more hypocritical to decry the current administration’s efforts to curb illegal immigration as being unlawful when these laws have been on the books for years, many for decades.

“no one in america is above the law!” they scream. except, apparently, non-citizens who illegally enter our country

LikeLike

The landowner argument was thrown out in 1797… Do you really believe homeowners don’t pass Property Tax costs on to renters?

LikeLike

Everyone pays property taxes. Property taxes are built into the cost of every gallon of milk and quart of beer you buy. Property tax is built into the rent.

People need to be educated to that fact.

LikeLiked by 4 people

Yeah, but the bill for those property taxes is invisible to those who don’t own property. Consequently they tend to vote for nice to have projects without considering cost.

LikeLike

Well, those people are not as stupid as the property owners that get a tax bill and know full well about the tax implications, but still vote yes for the bonds.

LikeLiked by 1 person

These constant attacks on Beto serve no purpose and only identify an unknown person with issues. Grammar also counts and the proper expression is that they could *not* care less! Some people have to be the first with the least, and one (or more) of these unknowns certainly seems to be leading in that category.

LikeLiked by 3 people

Is this the same Greg Allen who is our police chief? If that is the case, what does that say about the legitimacy of a bond election being touted as benefiting police and fire departments?

LikeLiked by 1 person

If it is the same Greg Allen, I am assure you that his pension pays him enough that he can afford to water his lawn.

LikeLike

We should be able to vote on each part of the bond individually and not an “omnibus bond”…I personally believe to just $upport the EPPD.

LikeLiked by 1 person

Not talking about OP here, but sometimes I think the folks who complain the loudest about property tax rates not on principle but out of concern for their own wallet live in too much house in a neighborhood they can’t really afford. Adding in federal income tax deductions for mortgage interest and local property taxes the cries ring somewhat hollow.

“OMG I bought this 7mpg Hummer and the gas prices are too high!” Is this where Grouchy Old White Guys like me are supposed to say “suck it up, snowflake”? Maybe one only says that to Millennials. I forget.

The entire dynamic is described in The Homevoter Hypothesis by Fischel: homeowners buy an expensive, immobile asset with no way to insure against decrease in value. They then attempt (and usually succeed) to leverage the power of the State to protect them from financial loss/risk. Yay.

> My quality of life doesn’t allow me to water my lawn anymore.

Having a lawn in the desert is a luxury and self-inflicted wound.

BN: I have owned houses, rented houses, rented apartments, and lived off-grid on my family’s land. In each of these cases I lived within my means in humble surroundings.

LikeLiked by 1 person

Property taxes in El Paso are like a second mortgage payment. In most places, you pay off your mortgage and your overhead drops substantially for your retirement years. Here in El Paso, even after you pay off your mortgage you are still paying property taxes that are equivalent to a mortgage payment. That is one of the big reasons why El Paso is not a good place to retire unless you are wealthy. Property taxes have risen to a level that the old “no state income tax” argument is total bs. The developers and business people responsible for running up the taxes are wealthy people who can easily afford the taxes. They are clueless about what it is like to be middle class. Even worse, they do not care.

LikeLike

I flat disbelieve anyone who claims that their property tax bill equals their mortgage! Our taxes, if our mortgage was paid off, would equal about 1/10th of what the current mortgage payment is. Our property tax bill for the year, plus the cost of home owners’ insurance might equal two month’s mortgage payment.

LikeLike

My property tax works out to $816 per month, and that is higher than the mortgage payment I had on my first house in the 70s (which was financed at 13% interest). If I were to add my home insurance and property tax together, it would represent about 5 months of the mortgage payments I used to have on this house.

LikeLike

My parents bought their house in 1971, in an affordable neighborhood that was within their budget. My dad has passed, but my mom still lives there. She’s hardly living in the lap of luxury, but she’s been hit with an enormous tax bill and she’s retired and constantly worrying about how she’s going to pay-even with exemptions. And she xeriscaped her lawn years ago. The city is careening towards a budget disaster ala Detroit and they are lying, obfuscating and spinning to save their lives. I don’t live in El Paso anymore, the reasons are legion, but I worry about my mom not being able to afford to live in the home she’s owned since 1971 because the taxes are just ridiculous. And I’m pretty dang liberal and support taxes to pay for public services. But I don’t support taxes to pay for vanity projects, incompetent managers, bad public policy and a grifty City Manager. And anyone with ANY background in public administration will tell you that you never use one-time funds to pay for ongoing expenses, that’s budget management 101, so those bonds and COs are bad, bad budget policy. But, fun fact-did you know voters can repeal COs? City doesn’t want you to know it, but it’s the law. El Pasoans need to tell their local government bodies what they seem to be telling El Pasoans- live within your means. Is it sexy? No. But the bills will be paid.

LikeLiked by 1 person

Very well, said. And Frater Jason, I own my house outright, because I prioritized paying it off over other spending. My taxes have nearly doubled in the last 15 years. My salary and the CPI have not. It is unreasonable for local governments to tax people out of their houses. And telling folks to sell their nice homes and move into shacks in low income neighborhoods to better afford taxes is sheer stupidity. The foolish spending is being done by our local yokel politicians and their crony big donors.

LikeLiked by 1 person

And one other thing. Those of us with no mortgage interest no longer have a way to deduct high property taxes, since the individual deduction exceeds the SALT cap, so implying that those of us with paid off houses and high taxes are “living off the state” via our deductions is no longer true. I like the tax cuts and the fact they do put pressure on local governments to reduce property tax burden by capping that deduction.

LikeLike

I made no claim that anyone was living off the state. I think taxes are evil, particularly when nonpayment they can result in the forfeit of one’s wholly owned property.

LikeLike

Folks tell other folks to move to places they can afford all the time.

> telling folks to sell their nice homes and move into shacks in low income neighborhoods to better afford taxes is sheer stupidity.

People who do not adjust to financial change will suffer. It has always been so. IMO stupidity is stubbornly holding onto a white elephant one cannot afford.

LikeLike

You fail to differentiate a key point. It is one thing for an individual to buy a house they can’t afford and a totally different issue for someone to be taxed out of house they could afford. The fiscal irresponsibility of our local leaders is increasing taxes at a level that is taxing folks out of homes they reasonably expected to retire in. Criticizing homeowners for holding on to an asset that is only becoming a financial drain simply because of out of control tax increases is crazy. Our Mayor keeps going on record complaining that CAD valuations aren’t growing fast enough. Look around at home prices. New construction of smaller homes with postage stamp size lots comes with pricing that is at or higher than most older, larger homes. The only way to downsize and reduce taxes is to buy a dump in a neighborhood filled with poorly maintained homes. This is a bad option for the elderly. We don’t have the retirement communities that many places have because the national builders that specialize in those see our tax structure as cost prohibitive.

LikeLike

> You fail to differentiate a key point. It is one thing for an individual to buy a house they can’t afford and a totally different issue for someone to be taxed out of house they could afford.

I do see the difference. And I see the end result for both is the person losing the house.

People buying relatively nice homes in areas with overall low home values are going to get hammered; that shouldn’t be a surprise no matter when the house was purchased.

“Property values are the other crucial factor explaining differences in property tax rates. Cities with high property values can impose a lower tax rate and still raise at least as much property tax revenue as a city with low property values.

For example, consider San Francisco and Detroit, which have the highest and lowest median home values in this study. The average property tax bill on a median valued home for the large cities in this report is $3,039. To raise that amount from a median valued home, the effective tax rate would need to be more than 20 times higher in Detroit than in San Francisco—7.25 percent versus 0.36 percent. ”

Click to access 50-state-property-tax-study-2016-full.pdf

Best case, tax-wise: buy a modest house in a wealthy area.

Worst case, tax-wise, buy a nice house in a poor area.

> Criticizing homeowners for holding on to an asset that is only becoming a financial drain simply because of out of control tax increases is crazy.

Homeowners cannot control tax rates, and still buy expensive immobile assets subject to those rates. Worse, the transaction costs for changing homes/locations is significant.

Would anyone sign a long-term contract to shop only at Albertson’s, knowing 1. the prices will always be relatively high; and

2. they have no control of future prices;

3 and breaking the contract would involve significant penalties?

> The only way to downsize and reduce taxes is to buy a dump in a neighborhood filled with poorly maintained homes.

There’s a lot to unpack in that sentence, but I will leave it to each reader to do the unpacking.

Living within one’s means, making do: these are classical virtues. There is honor in reassessing a situation and changing course when it is required.

IMO it is not civic (or any other) government’s job to ensure people live the lifestyle they prefer or have grown accustomed to.

> This is a bad option for the elderly.

Not sure why that would be so. Humbler neighborhoods tend to respect the elderly more, visit with neighbors more, and social services are usually more often found there.

Plus the menduo is better, and sometimes I think good menudo is the key to a long and happy life. 🙂

LikeLike

In the proposed $1 billion bond, the $310 million earmarked for the EPPD is ALL for facilities and vehicles. It is NOT to put more officers on the street. This money will not make the city any safer. The police department will not be any more responsive. Construction companies however will make a lot of money. Some people are trying to make as much as they can as fast as they can at taxpayer expense.

https://www.kvia.com/lifestyle/money/city-council-discusses-nearly-1-billion-bond-projects/1098342330

LikeLiked by 1 person

And let’s talk about animal services. A 90% release rate if we pass the bond? The fundamental problem in this community is folks who see pets as disposable. They don’t vaccinate, spay or neuter. They keep these pets in backyards and end up with accidental pregnancies. They also regularly do backyard breeding and sell those pets in store parking lots or flea markets. If an animal becomes inconvenient they either surrender it or turn it loose. There have been significant education efforts in the community for over a decade and changes to laws that are only obeyed by a small percentage of our community. In short, efforts to solve the problem have just increased the costs of responsible pet owners. But, telling folks the money will be used to help puppies and kittens is one way to manipulate voters.

LikeLike

Note for onlookers: a 90% live release rate is the threshold after which a shelter can call themselves “no kill”; perhaps that is what they are shooting for.

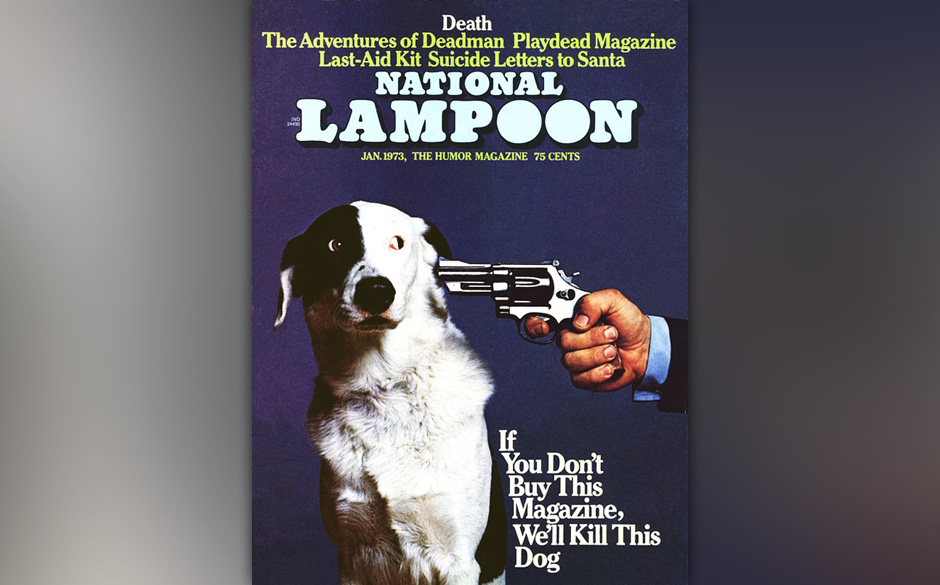

My original take was that they wanted the virtue signal of having a no-kill city shelter, but you’ve made me rethink it. If you are right it would be akin to the National Lampoon “buy this magazine or we kill this dog” cover:

LikeLike

I partially agree with you on this: the bond proposition is basically spend this money and we’ll stop killing dogs. The reality is after you vote yes, they’ll still be pulling that trigger and blaming community behavior for their inability to solve the problem in spite of spending more money. In a lot of ways, that is even worse.

LikeLiked by 1 person

Just vote no. I will.

LikeLike

We deserve better but I fear we’re not going to get it.

LikeLike