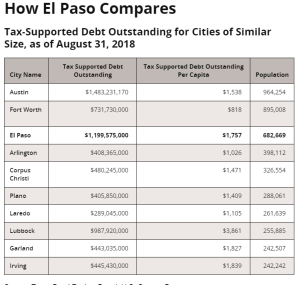

Take a look at how the city of El Paso compares to other comparable cities in Texas when it comes to debt:

The chart comes from the Texas comptroller’s web site.

Only Austin had more tax supported debt than us in 2018.

However our city went another $161 million into debt in January of 2019. Remember that those numbers do not include the multi-purpose performing arts center or the children’s museum or the multi-cultural center.

We deserve better

Brutus

Or an arena. Broke cities always get an arena shortly before going bankrupt. But here we need an arena, because we are such a sports oriented city. Of course, after we build an arena businesses will come here in droves and the skies will open. It will rain prosperity for a thousand years. The bankruptcy will merely be a formality of not having enough actual money to cover the debt.

We are already at 57% of our general budget on debt service. When that hits 75% it will have a multiplier effect and be like we have more money to spend on debt than things we need. It will be great, especially for taxpayers.

LikeLike

Since unspent bond-related debt is not shown on this chart, how do you know that the other cities don’t have a greater unused bond-related debt? This seems to be a “sort of” correct slide if you don’t include those figures for all of those cities.

LikeLike

Your line “the whole picture is a better picture” infers that it is in fact a better picture if all that is included. Are you sure about?

The following article about muni debt bombs was written 10 years ago. El Paso ignored these red flags and continued to pile on debt.

https://www.city-journal.org/html/muni-bond-debt-bomb-13298.html

LikeLike

What makes this fact even worse is that the average El Pasoan makes an average yearly income of $20,150 while the average Texan (every other Texan in every other Texas city) makes an average income of just over $30,000 per year.

This figure has to be examined in relative context…

Outside of Austin, every individual El Pasoan owes BY FAR more city debt than any other city listed on the graph, YET we as individuals make 33% LESS in income per year.

To wit, the average Austin resident makes far more than $30,000 per year as well.

El Paso has a rock bottom yearly average while Austin is near or at the top in yearly income.

LikeLike

Dig a little deeper in comparison El Paso to Austin. The taxes on a $250,000 home in Austin are about 20% less than in El Paso. $4,500 vs. $5,600. The more important number on your chart is that while Austin’s total tax-supported debt might be higher, El Paso’s debt is higher on a per capita basis. Because El Paso incomes are lower than Austin, El Paso residents are having to give up a significantly greater percentage of their income for taxes. Our tax-supported services and amenities do not begin to compare to Austin and the people in Austin actually know what they are doing when it comes to economic development.

LikeLike

The real issue is that Austin has more large employers than EP and business pays a much larger share of property tax as a result. Plus they actually have a viable tourism strategy.

LikeLike

I suppose that, welI, I think we all know that El Paso has a LOT of unreported cash income. Half the families do not have a bank account. We also have 2 and 3 and 4 families living in single family homes with converted garages and upstairs living quarters.

In the other Texas cities there is not so much unreported/cash incomes.

El Pasoan’s have learned to adapt and keep homes in grandma’s name so the property taxes are 1/3 less.

(Even though grandma moved to Maine 20 years ago and has been dead for 15 years and the El Paso taxing / city tax collector knows nothing about it.)

(that’s still no excuse for El Paso’s high debt.)

I wonder what the average El Pasoan BUYS each year in El Paso ?

(Retail sales per person . . . versus . . . other Texas cities.)

That might be more telling what El Pasoan’s REALLY have to spend.

LikeLike

Your description makes El Paso sound like a third-world country.

As for bank accounts, you don’t need a bank account if you’re living paycheck to paycheck and all of your paycheck goes out the minute you get paid.

As for retail sales per El Pasoan, it’s nearly impossible to calculate that number because local retail sales include sales to Mexico residents.

If you think for a second that El Paso incomes are comparable to incomes in Austin, you’re smoking something other than Lucky Strikes.

LikeLiked by 1 person

I am so tired of the abuse. No justice for us in El Paso.

LikeLike

Irving is pretty high too. Pattern for city manager?

LikeLike